Over the past 2 years whilst trading the financial markets, I've had my fair shares of ups and downs. So, I wanted to share three quick "life lessons" that trading and investing has taught me so far as oftentimes it's easy to forget about these transferable benefits and focus only on our percentage returns, losses etc.

Momentum

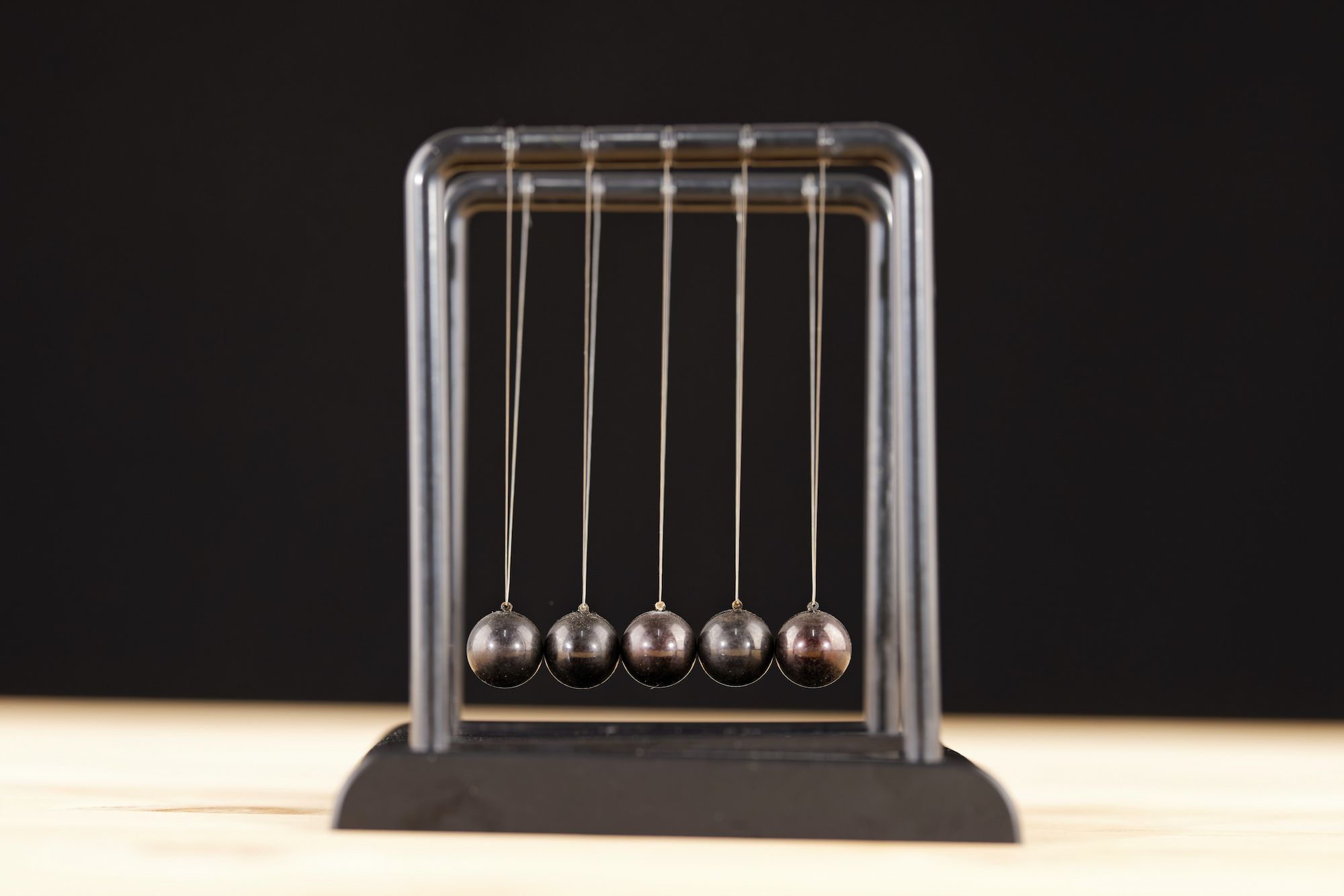

The law of Momentum is a universal law that states:

There can be no change without movement. Simply put, if you want a change to occur, you must push for it. In any case you must exert some effort to make change, if you do nothing, nothing will change.

Put in a different way, whether it's something with a positive or negative push either caused by you or something else, things tend to continue moving in that way.

So a good rule of thumb that may seem basic, but is deceptively difficult, is to try and stay and/or work towards being on the right side of positive 'pushes' and creating a compounding effect.

Framing this with trading and investing, instead of high risk high reward strategies and speculation, a much better and effective principle would be to create lots of small 'positives' which can in turn, thanks to the law of momentum, compound into greater positives.

Even outside of trading and investing, this small win mindset can be applied to the smallest tasks in your day-to-day routine.

Practical examples of building positive momentum

One of the best and most effective ways I've found to help compound positive momentum is generally structure your day around the things you least want to do first. By ticking that off, you give yourself confidence for the rest of the day as what you really wanted to achieve is already done.

Patience & delayed gratification

In trading and investing, the intraday swings often fueled by the torrents of the media (especially in 2020), makes the the financial markets increasingly volatile and enticing for those of us looking to make a quick buck and 'beat the market' so to speak. My personal experience is no exception to this, and has always been a challenging mental wall to break through.

However, it's not uncommon for me that I've taken a certain opportunity in the markets, taken a short-term loss, but only to check back in weeks, months or years to see that actually my initial idea would have played out in my favor if I had had the patience and a more 'long-term' mindset.

In the social media lockdown era, it's easy to fall into the negative spiral of comparing ourselves to what we see on our screens and looking for the shortcuts that will allow us to get there. But oftentimes we can't force an opportunity, but it's important to remain patient and grasp opportunities when they presented to us.

Herd mentality and digital diet

Herd mentality is the inclination for individuals within a group to follow along with what the group at large thinks or does.

Like many spaces and sectors in today's world, herd mentality is both a blessing and a curse. In the investment world specifically, there is a whole lot of 'herd-noise' constantly being pushed out and the impact of this can largely be summarized by two words - conflict of interest.

Now I'm not saying this to encourage you to disconnect from various important global issues, but a valuable lesson I've learned from investing and trading is to dive deeper then what you see at face-value on traditional news outlets, social media channels etc. and come to your own conclusion before you decide to "follow the herd".

In my personal experience, this has often involved stepping away from the screen, looking around you at what is right in-front of you and taking the time to let your brain ponder and formulate individual thoughts and ideas.

It may be easier to imitate others, but to give your brain the space to craft and formulate original ideas is more likely to bring you greater joy, success and satisfaction in your personal life and career then simply being a victim of the 'herd mentality'.

Last words

These three life lessons learned from trading and investing - momentum, patience and herd mentality - all have the potential to be blog posts in themselves and may well become in the future, but for now these are some of the, often forgotten, transferable lessons and benefits that trading and investing provides outside of the obvious monetary benefits.

What are some of your lessons learned from trading and investing? Let me know your thoughts by email at kier.p.glover@gmail.com