At its core, fear of missing out is a type of social anxiety that stems from the belief that may be having fun or doing something interesting without you. This is also a very common aspect of trading, especially with new traders and something I personally wrestle with in my trading career.

So I thought I would share my experience as a relatively new participant in the financial markets, what I've learned and some practical methods of removing yourself from FOMO.

A note on risk management

Something that massively helped me remove FOMO from my trading and investment decisions was making sure to frame myself as a risk manager, not a trader. This simple trick of mentally changing my 'job title' to risk manager, massively helps shift your mindset to one of preserving capital instead of having a lottery mentality.

With this state of mind, you can identify that FOMO is irrational as 1) you can't lose your capital if you're not trying to chase the hype. 2) By the time it's hype and covered on MSM (main stream media), it's already too late, so you're better off waiting for a better opportunity.

Trading as a business

A second mindset shift that has helped me remove myself from FOMO is treat your trading as a business. Like with any other business, most owners wouldn't jump into to certain opportunities just because everyone else is doing it. They would be more analytical, take time to think through potential risks that may impact their bottom line before making an informed decision that wasn't just an emotional response to a certain opportunity.

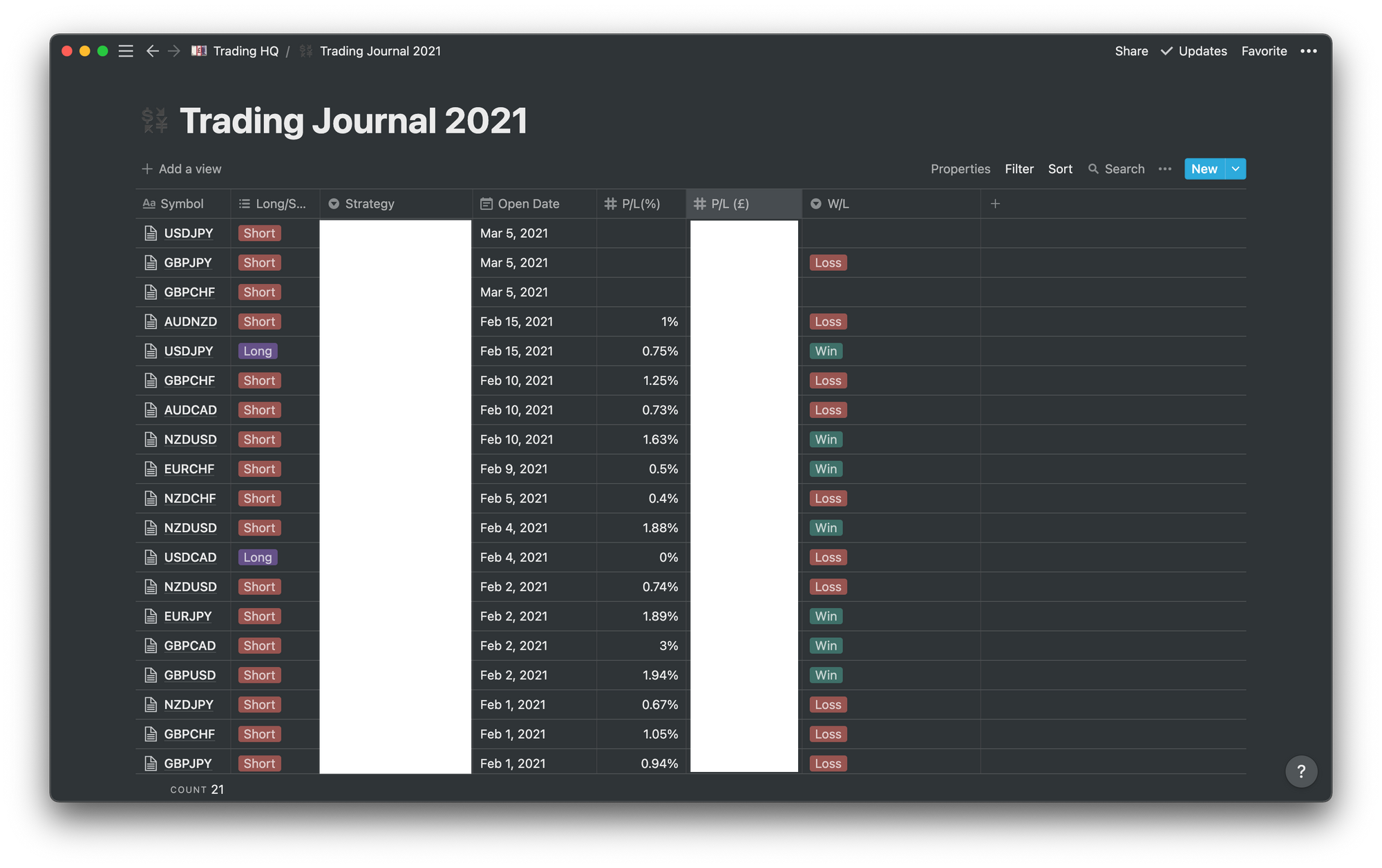

For me, journalling every trade and making sure to dig deep into how I was feeling when taking it has really helped me with this. I use a tool called Notion to do and you can see how I lay this out below.

Have a trading bible

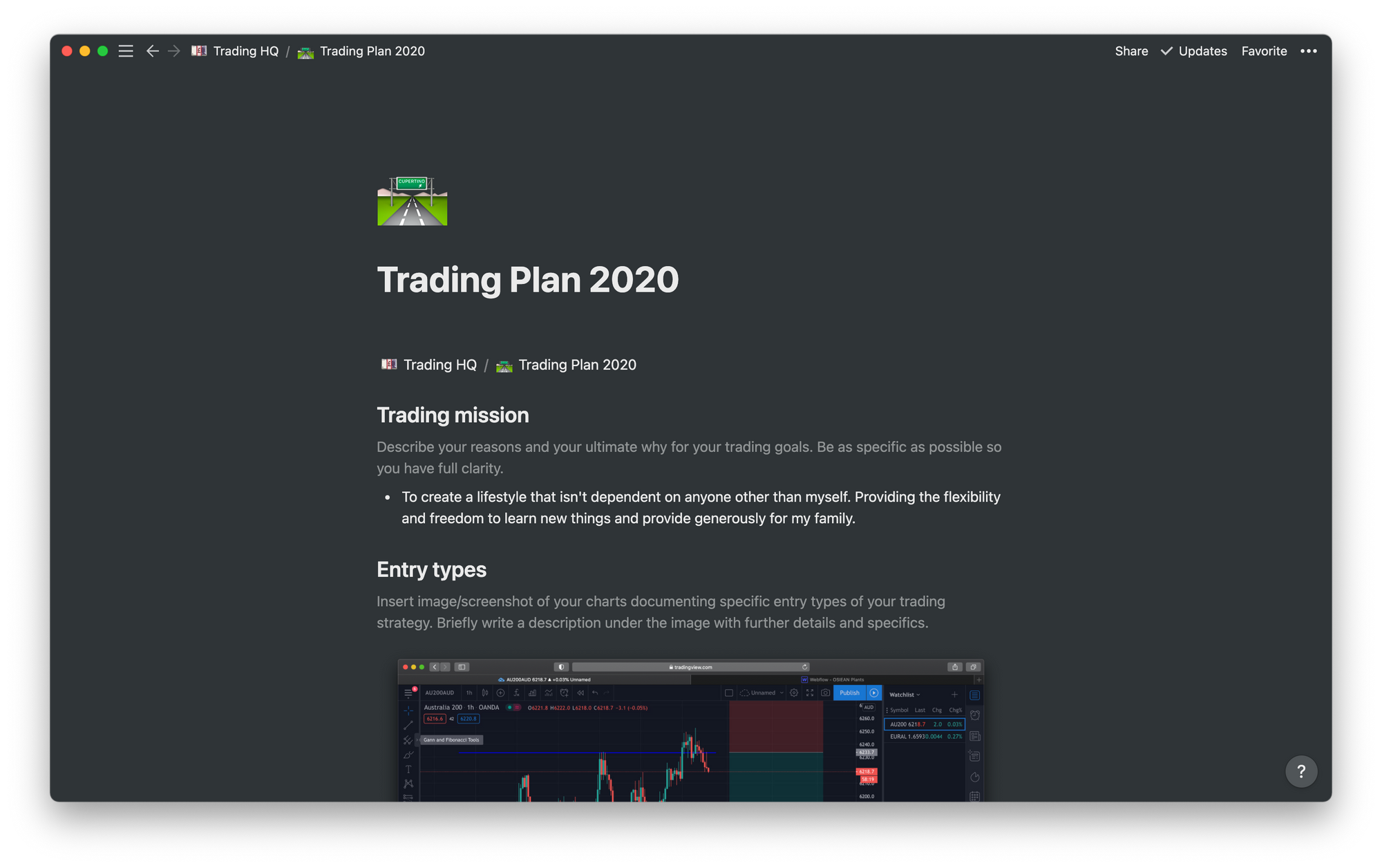

Maybe obvious to some, but not to brand new traders and potentially one of the most powerful tools in these note; have a trading bible digitally or even physically printed. Inside the journal, list down strategies and trade examples within each strategy and ensuring that you stick to it 100%. This removes the guess work, removes the FOMO and paired with a trading journal as mentioned above allows you to refine and improve in an undistorted way. Here's a screenshot of mine from last year, but am planning of printing copy or two to have on my desk.

Don't believe the hype

Without sounding older than my age (I'm only 27 😅) in today's world, but especially in the trading world, there's different parties with different agendas working either for or against you. So that's why it's important to do as much as you can to avoid external bias and make your own informed decisions. This again goes for more than just trading, but assuming you have a decent strategy in place simply stick to it and ignore everything else that doesn't fit to your particular strategy or style of trading or investing.

Closing words

Reading back on this, on the surface these things seem basic and obvious - but in reality when there's either your own or other peoples capital at risk people throw these things out the window - and trust me when I say it I've been there and I'm still a work in progress.